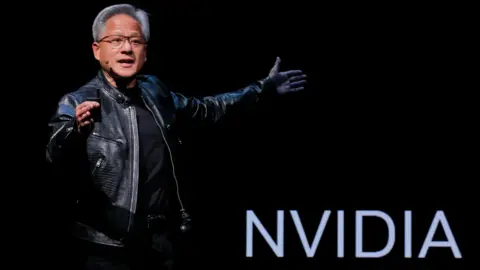

Nvidia has achieved an unprecedented financial milestone, becoming the first company worldwide to reach a market capitalization of $5 trillion (£3.8 trillion).

The prominent U.S. chipmaker has undergone a dramatic transformation, rapidly evolving from its origins as a specialized graphics-chip designer into a leading titan in artificial intelligence. This remarkable ascent is fueled by a relentless demand for its advanced processors, driven by widespread enthusiasm for AI’s burgeoning potential. Consequently, the company’s stock has consistently soared, reaching unprecedented record highs.

The company has experienced a remarkable surge in its market valuation, first surpassing the $1 trillion milestone in June 2023, and then astonishingly multiplying that figure to reach a $4 trillion valuation just three months ago.

Shares of semiconductor giant Nvidia experienced a robust surge on Wednesday morning, climbing by as much as 5.6% to surpass $212 per share. The boost was fueled by renewed investor optimism regarding the chipmaker’s sales prospects in China, a market often at the heart of geopolitical contention.

Here are a few options, maintaining a clear, journalistic tone:

**Option 1 (Direct and Strong):**

“The world’s most valuable company has cemented its position as the leading beneficiary of the substantial AI spending surge, decisively outperforming its competitors across the technology sector.”

**Option 2 (Slightly More Descriptive):**

“In a clear demonstration of its dominance, the world’s most valuable company has emerged as the principal winner in the intense AI investment race, leaving its tech sector rivals far behind.”

**Option 3 (Concise and Impactful):**

“Capitalizing heavily on the burgeoning AI investment boom, the world’s preeminent company has dramatically widened its lead over all other players in the technology sector.”

The company has secured pivotal agreements with leading AI companies, including OpenAI and Oracle, as its chips continue to be instrumental in powering the burgeoning artificial intelligence boom.

Nvidia’s market capitalization has achieved a truly staggering scale, now eclipsing the Gross Domestic Product of nearly every country worldwide, with only the United States and China boasting larger economies, according to World Bank figures. This monumental valuation also surpasses the combined worth of multiple entire sectors within the S&P 500 index.

Here are a few options, maintaining a clear, journalistic tone:

**Option 1 (Concise):**

“Tech titans Microsoft and Apple recently surpassed the $4 trillion valuation mark, further bolstering a broad market rally driven by Wall Street’s bullish outlook on artificial intelligence spending.”

**Option 2 (Slightly more descriptive):**

“The recent achievement of a $4 trillion valuation by both Microsoft and Apple highlights a robust tech sector rally. This surge is largely fueled by significant investor optimism on Wall Street regarding future expenditures in artificial intelligence.”

**Option 3 (Focus on the reinforcement):**

“Microsoft and Apple have now joined the elite club of companies with market capitalizations exceeding $4 trillion. This milestone reinforces a broader upturn in the technology market, a trend primarily propelled by Wall Street’s confidence in anticipated AI investments.”

Artificial intelligence companies have emerged as the dominant force driving the U.S. stock market’s exceptional performance this year, single-handedly responsible for an astonishing 80% of its overall gains.

However, as technology stocks repeatedly scale new heights, apprehension is intensifying over a potential AI bubble, fueling doubts about the sustainability and true value of these burgeoning companies.

Leading financial institutions and a prominent banking chief have issued stark warnings, underscoring concerns about prevalent underestimations of risk. Both the Bank of England and the International Monetary Fund have sounded the alarm, a sentiment powerfully echoed by JP Morgan CEO Jamie Dimon. Speaking to the BBC, Dimon explicitly cautioned that “the level of uncertainty should be higher in most people’s minds.”

Danni Hewson, AJ Bell’s Head of Financial Analysis, characterized Nvidia’s **staggering $5 trillion valuation** as a sum of such immense proportions that it is **virtually impossible for the human mind to fully comprehend.**

Here are a few options, maintaining a journalistic tone:

**Option 1 (Concise):**

She added that the development would do little to assuage persistent fears of an AI bubble, though the market appeared determined to press on regardless.

**Option 2 (Slightly more descriptive):**

“While this will do nothing to quell anxieties surrounding a potential AI bubble, the market nonetheless seems intent on its continued advance,” she noted.

**Option 3 (Emphasizing market resolve):**

She observed that the situation would fail to alleviate concerns about an AI bubble, yet the market demonstrated a clear resolve to continue its trajectory.

**Option 4 (Varying sentence structure):**

Despite ongoing fears of an AI bubble, which this development would not dispel, the market seemed keen to forge ahead, she commented.

A growing number of financial observers are now publicly scrutinizing the rapid escalation in the market value of artificial intelligence technology companies. They question whether this impressive surge is, at least partially, a consequence of what they label “financial engineering.”

Here are a few options, maintaining a clear, journalistic tone:

**Option 1 (Concise):**

“An intricate network of cross-investments among prominent artificial intelligence developers is prompting a wave of critical examination.”

**Option 2 (More descriptive):**

“Leading artificial intelligence firms have become increasingly intertwined through a series of mutual investments, creating a complex financial web that is now drawing considerable scrutiny.”

**Option 3 (Focus on the ‘tangled’ aspect):**

“The growing landscape of reciprocal investments among top AI companies has created an elaborate and often opaque network of financial ties, a development now attracting close oversight.”

OpenAI, the company credited with launching artificial intelligence into the consumer mainstream through its ChatGPT debut in 2022, finalized a landmark $100 billion investment deal with Nvidia last month.